oregon workers benefit fund tax rate

In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment. If a taxpayer would have met the 90 threshold under the prior years rate 145 for tax year 2020 but does not meet the 90 threshold under the new BIT rate 200 quarterly interest.

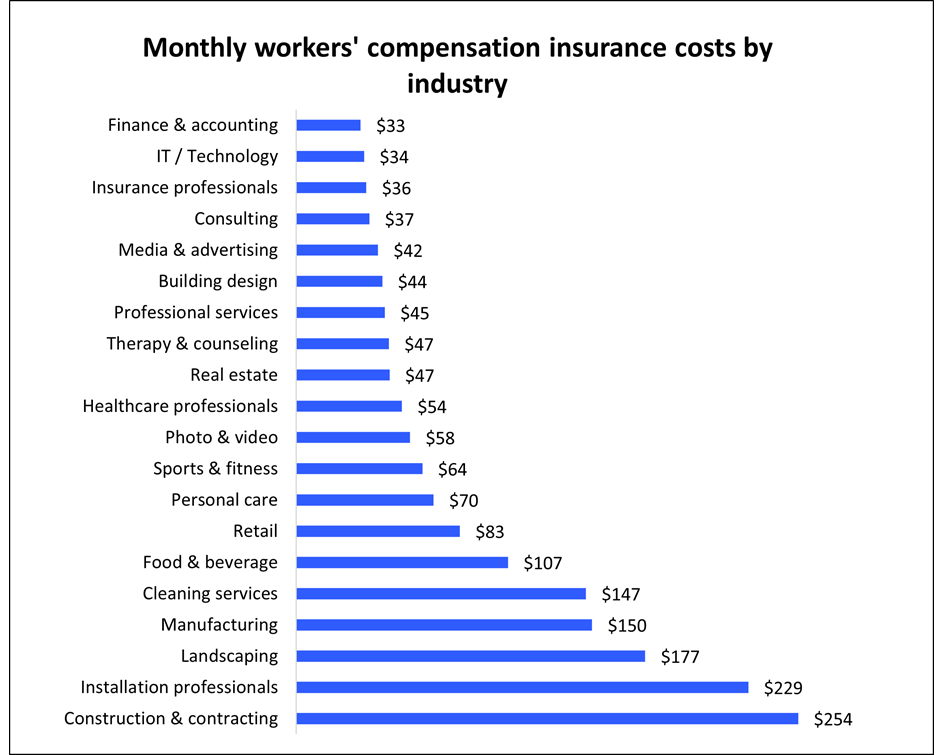

Workers Compensation Insurance Cost Insureon

You are responsible for any.

. Prescribe the rate of the Workers Benefit Fund assessment under ORS 656506. Ranking of each states workers. Oregon Workers Benefit Fund Assessment Report.

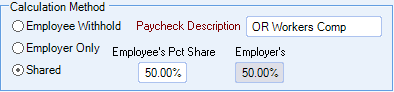

Employers and employees split this assessment. You are responsible for any. In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment.

They were sent separately to employers in De-cember of. The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged. The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers.

For 2019 our analysts. Oregon Workers Benefit Fund Payroll Tax Overview. The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers owners and officers covered by workers compensation.

Oregon Combined Tax Payment Coupons Form OR-OTC arent in this booklet. What is the Oregon WBF tax rate. Oregon workers are subject to Workers Benefit Fund WBF assessment tax.

For 2022 the rate is 22 cents per hour. The detailed information for Oregon Wbf Assessment Rate 2020 is provided. The detailed information for.

Workers Benefit Fund Assessment Oregon Administrative Rules Chapter 436 Division 070 Effective Jan. Go online at httpswww. You are responsible for any.

NE Salem Oregon 97301. Oregon Workers Benefit Fund Payroll Tax Overview. 84 percent decrease 2019.

This assessment is calculated based on employees per hour worked. If you are an Oregon employer and carry workers compensation insurance you must pay a payroll tax called the Workers Benefit Fund WBF Assessment for each employee covered under. Oregon workers benefit fund tax rate Saturday June 18 2022 Edit.

Oregon new market tax credit oregon new market tax credit. Employers use Forms OQ and OTC to. 653026 Nonurban county defined for ORS 653025.

These coronavirus stimulus checks from Oregon however would go only to low-income workers. The Workers Benefit Fund WBFprovides funds for programs that assist employers and injured workers. Oregon Workers Benefit Fund Payroll Tax Overview.

The Oregon workers compensation payroll assessment rate will not change in 2023. In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment. Oregon workers compensation costs already among the lowest in the nation will drop in 2022 for the ninth-straight year.

The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule with an average rate of 197 percent on the first 47700 paid to each employee. The Oregon Workers Benefit Fund WBF. Workers Benefit Fund Assessment Rate Workers Benefit Fund cents-per-hour assessment.

Prescribe the rate of the Workers Benefit Fund assessment under. 3 Workers Benefit Fund WBF Assessment Important information The 2022 Workers Benefit Fund WBF assessment rate is 22 cents per hour. Color-coded maps of the US.

The workers benefit fund assessment rate will be 22 cents per hour in 2023.

Business Services Worksource Oregon

The Growth In Applications For Social Security Disability Insurance A Spillover Effect From Workers Compensation

California Workers Compensation Class Codes

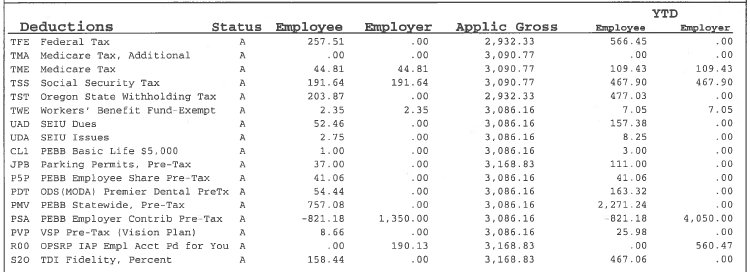

How To Read Your Earning Statement Business Affairs

Workers Comp Settlement Chart Average Payout Expectations

Workers Compensation Laws By State Embroker

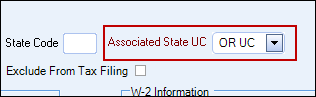

Oregon Workers Benefit Fund Payroll Tax

Unemployment Insurance Taxes Options For Program Design And Insolvent Trust Funds Tax Foundation

Workers Compensation Emerging Issues Analysis Lexisnexis Store

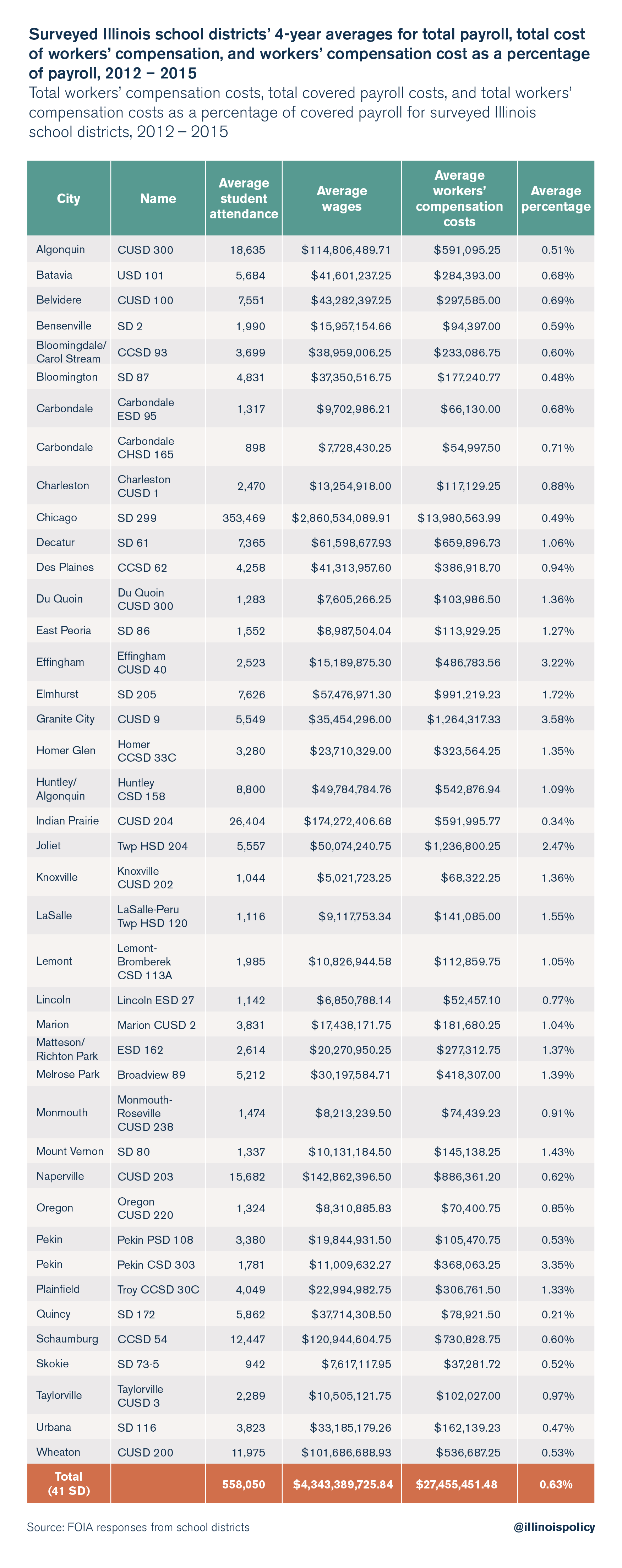

Workers Compensation Estimated To Cost Illinois Taxpayers Nearly 1 Billion Per Year Illinois Policy

The True Cost Of Paying An Employee Article

Oregon Workers Benefit Fund Payroll Tax

Benefits Oregon Business Industry

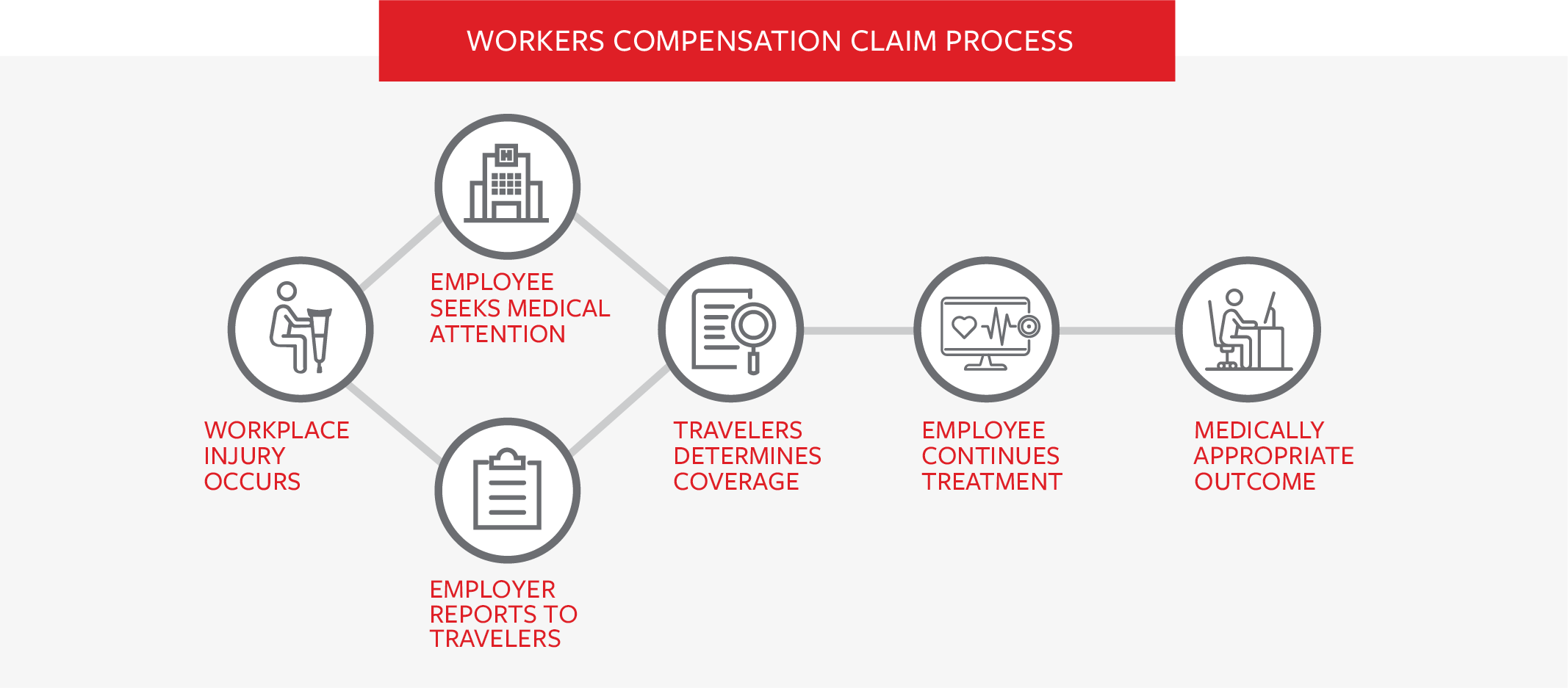

Workers Compensation Resources Travelers Insurance

Workers Compensation Death Benefits By State Interactive Map

Workers Compensation News Trends And Insights Insurance Journal